About Mike

Michael H. Johnson

MBA, Deloitte Alumni

It’s important to know and trust the person that you are dealing with. When analyzing and discussing Annuities and Life Insurance, you are clearly dealing with contracts. Mike is an Alumni of Deloitte (Big 4 Accounting Firm), where he evolved into a high-level Management Consultant in the 1980’s and then he became the Founding Partner of Intelligent Directions Consulting, LLC in the early 1990s. Over the years, Mike has managed procurements/projects from both the client and vendor perspective, driven by contracts totaling several hundred million dollars.

Mike has worked closely on projects with dozens of CPAs/CFOs/CEOs/Attorneys/Financial Advisors/Business Owners while at Deloitte and in the subsequent years. He has personal friendships with many of these professionals in the Southern California and Arizona regions. As an Independent Insurance Agent, Mike is a great team player and would love to work with your financial team...or with just you…if you are a team of “one” calling all of the shots.

Mike has chosen not to become a Financial Advisor for the simple reason that he wants to focus 100% on mitigating risks and building wealth by using just insurance-based products…without conflict…and without charging Management or Planning Fees. Much of this decision is also based on regrets that he didn’t personally take time to understand the benefits of Annuities and Life Insurance products earlier in life. He wants you to have zero market downside risks for the portion of your nest egg that he assists you with. Mike feels that too many people have become exposed to way too much risk in their investing…and way too late in life.

Most people have some understanding of the basic concepts of Life Insurance. Very few people understand the world of insurance-based Annuities, and even fewer people understand all of the hybrid products and product options that cross between Life Insurance, Annuities, and Long-term Care Insurance. Add in any associated tax consequences, then the size of the informed audience becomes even smaller. Mike, with his varied professional background spanning decades, is uniquely qualified to explain, communicate, and facilitate the necessary subject matter understandings with each client…and he enjoys it.

Try a BETTER Diversification Model. Consider variations of: 40% Bonds, 40% Stocks, and 20% Insurance Based Annuities. SAFETY while potentially earning a better return.

The professional gallery presented below should quickly raise your confidence and trust levels with Mike and help you understand who he is as a person. He was born and raised in San Diego and has spent decades working on projects all over the country, all while based largely in Southern California and Arizona.

Professional Years in Insurance

Specializing in:

• FIA (Fixed Index Annuities)

• MYGA (Multi-Year Guaranteed Annuities)

• Single Premium Life, Indexed Universal Life, Whole Life, Term Life

• Life and Annuity Tax Strategies for Personal and Business

• LIRP (Life Insurance Retirement Plans)

• Helping to educate people in all the above (that’s my job)

NOTE: Intelligent Directions Insurance Solutions does not sell “variable” products with uninsured client risk.

Professional Years in Consulting

Client Summary

Specializing in: “Case Management”, Management Audits and Reviews, Procurement Assistance and Managing Projects for:

• 20+ State and Local Courts around the US

• 10+ Health and Welfare State and County Agencies around the US

• 15+ Small and Large Multi-National Software and Hardware Technology Providers

• Several County/City: Assessor, Tax Collector and Auditor organizations

• LPGA Professional Player Sports Management, World-wide.

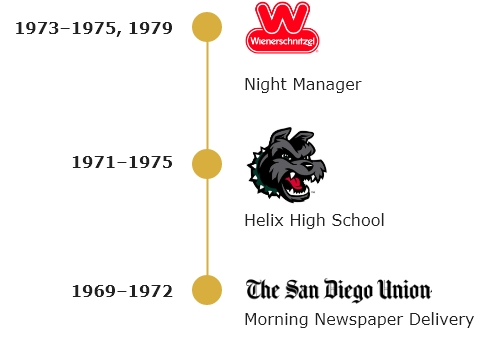

Professional Years in Employment

1985-89 Manager/Senior Consultant (Firms Merged 1989)

Client Summary

Specializing in: EDP Audits and Reviews, Management Audits and Reviews, Financial Audit IT Assistance, Procurement Assistance, and Manage Projects for:

• 25+ Corporate and Savings and Loan Audit Clients around US

• 15+ Large State and County Projects around US

![]()

1980-85 Manager/Senior Consultant

Client Summary

Specializing in: Detailed Analysis, Design and Programming on large IT Software Application Projects in UNIVAC Mainframe Environments:

• Internal Operations

• CalFed Savings and Loan

• Edwards Life Sciences

• United States Airforce

• Pennsylvania Department of Welfare

First Experience With Insurance

When Things Don’t Go As Expected, It is Comforting

to Know That Someone Has Your Back.

Teenage Years