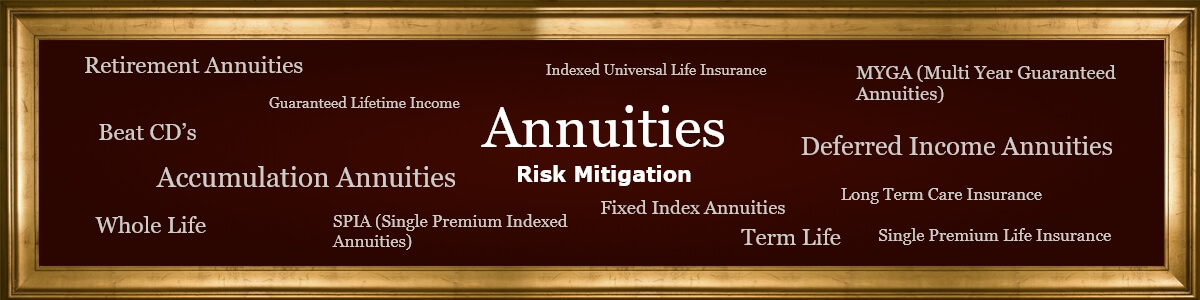

Fixed Index Annuity (FIA)

FIAs are the most popular, can be the most complex, and are potentially the most beneficial type of annuity. FIAs are structured to provide tax-deferred accumulation gains that provide some level of stock market exposure on the upside with no market downside. An “interest rate” is calculated (usually annually) based on stock market performance and is credited to different contract valuation accounts each year, where it compounds and grows on a tax-deferred basis.

As the name implies an “index,” or indices (S&P 500 is most common) are selected annually by the contract owner to be used to calculate their annual contract interest credit. This annual crediting process timeframe is called “Point to Point.” In the right margin here, you will see some of the more popular indices used in the various FIA contracts offered by various carriers.

A huge misunderstanding exists within the investment public, in thinking that annuities are just for decumulation based on a systematic spend down of client savings. The fact is that a large number of FIA annuities are held purely for accumulation because these contracts provide a very tax-friendly path to accumulating wealth. Many contract owners never turn-on the income spend-down or life-time income guarantee options on their contracts.

Try Intelligent Direction’s “Point-to-Point Zero Floor CAP Index Educational Tool,” with the S&P500 Honesty Button, and see how Annuities work internally to grow your money.

Additionally, unlike traditional IRAs, there are no annual contribution limits and no RMD’s with annuities. There are no earned income requirements in order to fund an annuity purchase or contribution. FIAs are excellent vehicles for younger people who max out their traditional retirement accounts each year and have an eye towards early retirement. For decades now, many professional athletes and their agents have recognized and invested in annuities for these reasons.

FIAs may offer many rider options, some of which are included at no charge, while some require a small annual contract premium deduction. These rider options are defined to:

- provide continued Increasing Income Growth even after contract withdrawals do start

- provide Long-Term Care (LTC) benefits

- provide Death Benefits

- provide other enhanced Accumulation or Benefit payout options, including guaranteed lifetime income

The “LTC self-insure” crowd will also note that FIA zero floor protection protects assets in down markets while still allowing for long-term asset growth…a very complimentary feature for the independently wealthy wanting to keep a portion of their assets safe. Within the contract guidelines, and especially after age 59.5, clients using well-thought-out strategies will have a high degree of control over their assets with annuities (and life insurance.)

Whatever level of wealth you are fortunate enough to acquire and hold, it shouldn’t mean turning down the use of safe well-managed capital found in insurance company risk pools. Insurance Companies are some of the best managed and safest business entities in the world, and as a group are often better capitalized and regulated than banks and brokerage houses. There is a reason that General Motors turned over their $25B Retiree Pension Plan to an Insurance Company (Prudential) in 2012 to manage under a group annuity contract.

Multi-Year Guaranteed Annuity (MYGA)

MYGAs compare most directly and favorably with CD investing. Just as the name states, these annuity contracts guarantee a stated interest rate for a stated number for years.

Interest rates offered by MYGAs are roughly 1% higher than CDs. Once you reach your late 50’s, there is very little reason to own a CD over a MYGA.

The differences are noteworthy:

- MYGA annual earnings are Tax-Deferred, while CD earnings are taxed each year.

- Money committed to a MYGA is being deposited into a retirement instrument. To avoid a 10% IRS withdrawal penalty before age 59.5, the client should plan on owning annuities at least until they reach age 59.5. Younger clients can chain together a series of annuity contracts every few years by executing 1035 exchanges into other annuity contracts going forward.

- Because MYGA’s tend to lock you into a higher rate of return, the early Surrender Fees are generally higher than those found with CDs. However, if you are past age 59.5, with many MYGA contracts you can take 10% withdrawals per year free of a Surrender Charge or an IRS fine. Few CD’s have provisions to waive any of their Surrender Fees.

- Once you are past age 59.5 there is really very little reason to own CDs over higher-yielding MYGA’s.

Single-Premium Immediate Annuity (SPIA)

As the name implies, these annuity contracts start by immediately generating a systematic stream of “income” payments (principal and interest), usually from the current date. Given that many companies have eliminated Pension Plans, many retirees decide to allocate some of their savings/401K funds to these annuity contracts to provide predictable and guaranteed cash-flow during retirement (for a specific period, or for “life”).

Long-Term Care Annuity (LTCA)

This is a unique annuity product based on the Pension Protection Act (PPA) that we really like when contracted into the right situation. LTCA’s have the sole designed purpose of amplifying a single annuity premium designated explicitly for potential Long-Term Care (LTC) expenses occurring at a later date.

If you “Self-Fund” Long-Term Care, why not set aside less money to do so? Did you know that you could use qualified IRA money to fund your Long-Term Care Annuity?

In exchange for a lower rate of return on annuity assets, the LTCA contract owner can have access to enhanced LTC funds amounting to 300-500%+ of the original premium. If needed, these LTC funds are paid out over a specified period (even up to “life”) depending on the premium rider options chosen. This annuity doesn’t perform as well as a pure investment, but if the need for LTC occurs, this annuity can act to shield some/all other client assets depending on how much you commit to it. If a client has the upfront capital to commit to this, it’s hard to provide this type of leveraged LTC coverage with any other method. Also, thanks to the PPA, the payouts from this type of annuity when used for LTC are withdrawn tax-free. Compare this concept with worrying about how you’d self-fund a potential LTC need. This annuity allows you to self-fund LTC with a smaller pool of self-funded reserves.

You need to consider an LTC Annuity while younger and healthier.

The health questionnaire and process for an LTCA are usually less rigorous than those required for an actual LTC Insurance policy, but you do need to enter into this contract when you are relatively healthy. These contracts are written with coverage specified as either “Single” or “Joint.” There may be a small outside premium required depending on the options that you choose. Great for people that say they want to “self-insure” LTC. If LTCA contract funds are never used for long-term care, then the current asset value of the annuity is available for wealth transfer (any gains taxable) upon passing.

Qualified Longevity Annuity Contract (QLAC)

QLACs are another specialty annuity product with a design based on the IRS Tax Code. QLACs were designed for use in Traditional (non-Roth) IRAs and 401ks to help retirees defer some of the required age 72 Required Minimum Distributions (RMDs). The IRS (under current tax law) allows retirees to exclude with proper use of a QLAC, up to 25% their Traditional IRA balance (subject $130K maximum) each year from the Required Minimum Distribution calculation. This QLAC deferral is a very tax-efficient planning tool when used to avoid withdrawals of money that a retiree does not need right away and does not want to pay taxes on (yet). The net effect of a QLAC annuity contract is to provide a 13-year tax deferral (until age 85) for a portion of an IRA that would otherwise be subject to mandatory taxable withdrawals. QLACs optionally can be contracted before age 72 to accumulate towards the current contract cap limit of $130,000.

New 2020 Tax Law changes for RMDs and QLACs. Contact us.

The Truth About Insurance Based Annuities

Fishy Sounding TV Salespeople….Apples aren’t Oranges! Nice Job of Confusing People.

Make up your own mind. Misconceptions About Annuity Contracts and Fees Set Straight:

After getting bombarded with negative marketing soundbites about annuities having “high fees” and “thick contracts”, we encourage people to at least spend some time getting familiar with all of the benefits of annuities; wealth accumulation, guaranteed lifetime income, etc. Intelligent Directions is here to help you with some clarifications about “fees“:

- Usually, there is a well-disclosed Surrender Fee structure (similar to a CD, but with key differences that vary with each contract, which we will always explain in detail upfront). Contractually, the Surrender Fees decline each year until they reach zero, and are based on what is clearly stated in each contract. Right-sizing the contracted annuity premium for each client and using targeted riders, works to avoid some of the potential need for a “surrender.” The idea is to not surrender and to instead hold the contract as intended for accumulated investment returns, which can ultimately drive income (if chosen). Obviously, there is no Surrender Fee if you don’t surrender.

- Ironically, some financial advisors may add Management Fees beyond normal internal sales commissions, to the annuity contracts that they sell and “manage.”**

- If a client decides to purchase an annuity contract offering annuity riders with an associated premium cost (“fee”), which the client voluntarily chooses, THAT is buying insurance (mitigating some risk) and purchasing a benefit in exchange for the additional premium. THAT premium is not a punitive fee as often portrayed by pundits. Examples of rider benefits; contract provisions for enhanced long-term care withdrawals, enhanced death benefits, guaranteed lifetime income, income “doublers”, etc.

Key Question: Can you get an Enhanced Long Term Care rider, Enhanced Income rider, Enhanced Death Benefit rider from your Brokerage Account?

- Occasionally there will be small fees charged for contract copies, wire transfers, etc. If there are any other fees, they should be well-disclosed upfront in the carrier contract for review during a free-look period.

- A few Insurance Companies will offer favorable contract rate index parameter options in exchange for a fee. Generally, we believe that it’s not a good idea to enter into one of these contracts.

- There are generally no administrative “Fees” with Insurance Company Annuity Contracts (Non-Variable*).

- TV pundits lump pure Insurance Annuities in with Variable* Annuities for advertising convenience in an effort to confuse people. Variable Annuities are “variable” and can go down in value as some components contain client-directed money invested directly into the stock market. Insurance Annuities contain NO direct investment of client money into the stock market, but rather are a contract with the insurance company that pays an annual interest rate. Fixed Indexed Annuities (see FIA’s section above) offered by insurance companies will peg some aspect of that interest rate to market performance, however, the annual “point-to-point” interest rate won’t go negative with a market down year.

The new SECURE Retirement Act advocates the expanded use of Annuities for some very good reasons.

- Annuity Contracts are very detailed for a reason…to protect the consumer. Insurance Company Annuity Contracts are heavily regulated and reviewed by each state before being offered for sale to the consumers in that state. Contracts are written in large font and contain bi-lateral promises. Can’t say the same for many unilateral prospectus brochures written in 6 point font, dropped in the mail.

Think about this: The individual companies that issue the stocks and bonds that you own (directly or indirectly), have no contracted promise with you to increase in value, or to pay you any specific dollar amounts if their business model fails. It’s all dependent on how they perform and continue to perform. Is that where you want to allocate your worry-free retirement safe-money?

- Our Clients do NOT experience Nose Bleeds. (Yikes). Face it, some in the financial industry view annuities as dead money…funds no longer available to “manage.”

Don’t Surrender to TV Salespeople

*Intelligent Directions Insurance Solutions does not write Variable Annuity and Life

Contract business with potentially higher fees and risk of some investment loss.

**Intelligent Directions Insurance Solutions is not licensed as a Financial Advisory firm (nor do we intend to become one).