Why Intelligent Directions

is Different:

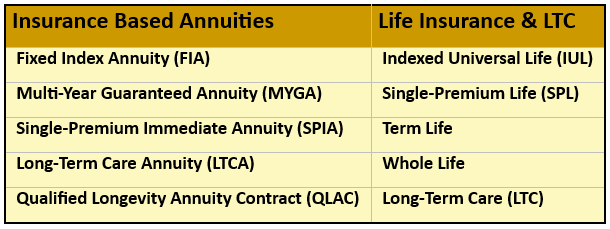

Intelligent Directions Insurance Solutions is a professional Independent Insurance Agency, licensed in both California and Arizona. We believe in working towards intelligent financial risk mitigation with insurance, by offering a variety of Annuity, Life Insurance, and Long-Term Care contracts from a few select top-rated carriers. We do not offer “variable” annuity or life contracts, because we feel that it would be conflicted to offer contracts with carrier stated down-side risks, while also trying to mitigate risks with various contract stated positive guarantees.

ALL Consultation Discussions, ALL Discussions at any time, are ALWAYS absolutely FREE of charge.

All & Always Free…PERIOD.

Intelligent Directions will never “make a play” to manage your entire net worth…we don’t do that. We are a team player because we feel that it is important to offer our annuity and insurance expertise and to plug into your existing circle of advisors if appropriate. We do not try to compete and “sell” towards any self-serving strategic direction. We don’t think about selling anything, we think about mitigating risks with smart strategies. Talk to us and see why we are different.

About Mike

Michael H. Johnson

MBA, Deloitte Alumni

It’s important to know and trust the person that you are dealing with. When analyzing and discussing Annuities and Life Insurance, you are clearly dealing with contracts. Mike is an Alumni of Deloitte (Big 4 Accounting Firm), where he evolved into a high-level Management Consultant in the 1980’s and then he became the Founding Partner of Intelligent Directions Consulting, LLC in the early 1990s. Over the years, Mike has managed procurements/projects from both the client and vendor perspective, driven by contracts totaling several hundred million dollars.

We want to be your trusted information source. We are teachers, not career solicitors. Our client conversations are our most treasured experience.

Mike has worked closely on projects with dozens of CPAs/CFOs/CEOs/Attorneys/Financial Advisors/Business Owners while at Deloitte and in the subsequent years. He has personal friendships with many of these professionals in the Southern California and Arizona regions. As an Independent Insurance Agent, Mike is a great team player and would love to work with your financial team...or with just you…if you are a team of “one” calling all of the shots.

“No Hassle” Knowledge and Education…

Welcome to our site! By some Round Table standards, we are the

- World’s Worst Sales People

…and we’re okay with that. Instead, we pride ourselves in

- Teaching Important Financial Subjects Misunderstood By Many

…as well as

- Helping You Protect and Build Wealth with LESS RISK.

This is NOT an aggravating lead generation website. Those sites that require deep disclosure of your personal information before they even share anything with you, are extremely annoying to us… so WHY would we put you through that?!

We Love to Teach, Consult, Explain… and if that’s ALL that we do… we consider THAT a “WIN” for everyone. Contact us with any set of questions. If you’d like us to walk you through some of our sample Annuity and Life illustrations, asking questions while talking on the phone, we’ll gladly do that… never any sales pressure.

Phone: 760.792.8500Phone: 760.792.8500 Toll-Free 24/7 Voice Mail: 800.354.8530Toll Free 24/7 Voice Mail: 800.354.8530 Contact UsContact Us

There is more educational information available on our FULL website

Let’s Get Focused

You are visiting our website to find better and safer returns. Good choice… you’ve found it. Now let’s get focused.

First, let’s eliminate some of your worries:

- Stop worrying about which stocks and mutual funds to be invested in.

- Stop worrying about shifting your investments in reaction to politics and changes/risks in the global economy.

- Stop gathering tax data and forms, filling out tax forms every year in support of 1 and 2.

- Stop making investment decisions that you don’t want to make, or paying people to make decisions for you who may cause you to lose money.

Instead, you can select highly rated Insurance Companies to manage a portion of your money. Many of these Insurance Companies have survived and flourished for over a century… since before and during two World Wars and the Great Depression. Insurance Companies are experts in investing their pools of capital in safe long-term investments. Contract premiums provide them with additional capital for those pools, and they then offer contracts guaranteeing a return back to annuity or life policyholders. All Insurance Company investment activities are closely regulated and audited by each state where they offer contracts. That’s the business model. You can use Intelligent Directions to help find you the annuity and insurance contracts that map to your needs and timeline. It’s really that simple.

Contracts with Insurance Companies really do provide a different safe asset class. Think about 40% Stocks, 40% Bonds, 20% Annuities

Next, a quick overview of how to focus on the information that will be relative to you. Which annuity and/or insurance contracts (listed above) are a good fit for your needs? Here is a list of starting points for you to consider:

Age 25+ :

- Depending on your marginal tax rates, and any employer “401K Match Rate” that you receive, it’s almost always smart to max out your IRA and 401K contributions first. Lean towards “Roth” if you’re able to do so.

- Consider purchasing (or transferring funds to) a Roth-IRA FIA. With currently low tax-rates, accumulating and positioning for Life-Time Tax-Free Income inside a Roth-IRA right now is as easy as it gets.

- Consider FIAs for long-term tax-deferred savings and accumulation. FIA’s have virtually no Contribution Limits (many have $1M contract limits), and no earned income requirements (you could earn $0 in a given year and potentially still purchase an annuity if you have the resources). Avoid RMDs later in retirement.

- Study and understand Intelligent Directions Point-to-Point ZeroFloor CAP Index Education Tool.

Young Families:

- Regularly Review your LTC and Life Insurance Coverages and Benefits. Depending on your budgets, you can blend the savings accumulation benefits of FIA’s in with Life Insurance needs using IULs, SPLs, Term Life and Whole Life.

Age 45+ :

- Time to REALLY Focus (if you haven’t already!) on Full-Retirement and Early Retirement. Continue to consider FIA’s and IUL, but also look at SPL contracts which provide an immediate enhanced Tax-Free Estate, and generally have less-rigorous health underwriting requirements. In addition to FIAs and IULs, certain SPL contracts can also provide future income streams.

- Review business plans and financing, and if funding is required, consider potential loans against the equity in life and annuity contracts.

Age 50+ :

- Look at FIA’s not just for accumulation, but for enhanced full-life income streams.

- For better returns, look at MYGA’s over CD’s.

- Start looking seriously at LTC. Our favorite is the LTC Annuity….one premium and you can be covered. The younger and healthier you are, the lower the premium and easier to qualify for…and you can purchase using qualified IRA money. With an LTCA if you never apply for long-term care benefits, and depending on your age when purchased, the underlying annuity structure could provide a remaining account balance, possibly some growth, and maybe some funds available for income. It all depends on age and health when the contract is purchased.

Age 55-85+ :

- Take a closer look at the projected longevity of your retirement income streams, and think about filling in gaps using FIA’s, IUL, SPLs.

- Again, study and understand Intelligent Direction’s Point-to-Point ZeroFloor CAP Index Education Tool. At this age the “power” of ZeroFloor also becomes the safety of ZeroFloor.

- Examine and regularly review planning for wealth transfer, charity gifting, etc., using IUL, SPL (and Whole Life).

- Finalize your plans for your Long-Term Care coverage or establish your self-funding methods. Consider LTC Policy, or a LTCA used to Self-fund.

- Look at a QLACs for your qualified retirement accounts where Required Minimum Distributions are a concern. Look at other strategies to help with excessive RMDs.

- Look at all of the above for your children and grandchildren…looking at their accounts going forward and consider annual gifting if appropriate.

The key difference between an Insurance Company contract, and any Brokerage or Mutual Fund Account contract, is that one guarantees a return while the other one guarantees to try to earn a return. Which sounds better?

Basic Strategies that Intelligent Directions can facilitate using Annuities and Insurance:

- Pure Long-Term Wealth Accumulation (Maximize Accumulation with Minimal Risk)

- Mitigate Personal, Family and Business Risks (Safe Wealth Accumulation, Health Issues, Premature Death, Taxes)

- Retirement Income (Longevity and Duration/Amount of Retirement Income, Taxes, and RMD Avoidance)

- Estate Planning (Maximize Wealth Transfer, Charitable Gifting, Taxes)

- Business Planning (Succession Planning, Business Financing, Retirement, Taxes)

Farmers have used insurance companies as their “bank” for decades. Highly-paid athletes (including Babe Ruth) and performers who had high earnings windows have known for over a century that Insurance Companies are a safer and more worry-free place to store and grow money. Investigate highly rated insurance companies, and you’ll find that their capital requirements are regulated to be much higher than banks and that they have historically far fewer failures than banks.

The financial press has been complicit in letting people forget the facts about Annuities and Insurance. Intelligent Directions wants to teach the past and bring it all back to the present.

The SECURE Act of 2019, promoting the use of annuities more in retirement planning, was just signed into law for a reason.

All Annuity contract types are described on the Insurance Based Annuities page (link below or on the main menu).

All Life and LTC contract types are described on the Life Insurance and LTC page (link below or on the main menu).

A limited few non-client specific Carrier Product Illustrations are posted as examples under the Contract News on this Home Page (below).

Better yet, give Intelligent Directions a call to answer any of your questions. We like questions and we’re easy to talk to.

Let’s Get Focused

You are visiting our website to find better and safer returns. Good choice… you’ve found it. Now let’s get focused.

First, let’s eliminate some of your worries:

- Stop worrying about which stocks and mutual funds to be invested in.

- Stop worrying about shifting your investments in reaction to politics and changes/risks in the global economy.

- Stop gathering tax data and forms, filling out tax forms every year in support of 1 and 2.

- Stop making investment decisions that you don’t want to make, or paying people to make decisions for you who may cause you to lose money.

Instead, you can select highly rated Insurance Companies to manage a portion of your money. Many of these Insurance Companies have survived and flourished for over a century… since before and during two World Wars and the Great Depression. Insurance Companies are experts in investing their pools of capital in safe long-term investments. Contract premiums provide them with additional capital for those pools, and they then offer contracts guaranteeing a return back to annuity or life policyholders. All Insurance Company investment activities are closely regulated and audited by each state where they offer contracts. That’s the business model. You can use Intelligent Directions to help find you the annuity and insurance contracts that map to your needs and timeline. It’s really that simple.

Contracts with Insurance Companies really do provide a different safe asset class. Think about 40% Stocks, 40% Bonds, 20% Annuities

Next, a quick overview of how to zero in on the information that will be relative to you. Which annuity and/or insurance contracts (listed above) are a good fit for your needs? Here is a list of starting points for you to consider:

Age 25+ :

- Depending on your marginal tax rates, and any employer “401K Match Rate,” almost always max out your IRA and 401K contributions first. Lean towards “Roth” if you’re able to do so.

- Consider purchasing (or transferring funds to) a Roth-IRA FIA. With currently low tax-rates, accumulating and positioning for Life-Time Tax-Free Income inside a Roth-IRA right now is as easy as it gets.

- Consider FIAs for long-term tax-deferred savings and accumulation. FIA’s have virtually no Contribution Limits (many have $1M contract limits), and no earned income requirements (you could earn $0 in a given year and potentially still purchase an annuity if you have the resources). Avoid RMDs later in retirement.

- Study and understand Intelligent Directions Point-to-Point ZeroFloor CAP Index Education Tool.

Young Families:

- Regularly Review your LTC and Life Insurance Coverages and Benefits. Depending on your budgets, you can blend the savings accumulation benefits of FIA’s in with Life Insurance needs using IULs, SPLs, Term Life and Whole Life. Learn how to use an Insurance Company as your own bank (farmers have been doing that for years).

Age 45+ :

- Time to REALLY Focus (if you haven’t already!) on Full-Retirement and Early Retirement. Continue to consider FIA’s and IUL, but also look at SPL contracts which provide an immediate enhanced Tax-Free Estate, and generally have less-rigorous health underwriting requirements. In addition to FIAs and IULs, certain SPL contracts can also provide future income streams.

- Review business plans and financing, and if funding is required, consider potential “loans” (tax-free cash flow) against the equity in life and annuity contracts.

Age 50+ :

- Look at FIA’s not just for wealth accumulation, but for enhanced full-life income streams.

- For better returns, look at MYGA’s over CD’s.

- Start looking seriously at LTC. Our favorite is the LTC Annuity….one single premium and you can be covered. The younger and healthier you are, the lower the premium and easier to qualify for…and you can purchase using qualified IRA money. With an LTCA if you never apply for long-term care benefits, and depending on your age when purchased, the underlying annuity structure could provide a remaining account balance, possibly some growth, and maybe some funds available for income. It all depends on age and health when the contract is purchased. Many FIA’s have enhanced LTC assistance payouts with no health exam.

Age 55-85+ :

- Take a closer look at the projected longevity of your retirement income streams, and think about filling in gaps using FIA’s, IUL, SPLs.

- Again, study and understand Intelligent Direction’s Point-to-Point ZeroFloor CAP Index Education Tool. At this age the “power” of ZeroFloor also becomes the safety of ZeroFloor.

- Examine and regularly review planning for wealth transfer, charity gifting, etc., using IUL, SPL and Whole Life.

- Finalize your plans for your Long-Term Care coverage or establish your “self-funding” methods. Consider LTC Policy, or a LTCA used to set aside the “self-fund” cash flow.

- Look at a QLACs for your qualified retirement accounts where Required Minimum Distributions are a concern. Look at other strategies to help with excessive RMDs.

- Look at all of the above for your children and grandchildren…looking at their accounts going forward and consider annual gifting if appropriate.

The key difference between an Insurance Company contract, and any Brokerage or Mutual Fund Account contract, is that one guarantees a return while the other one guarantees to try to earn a return. Which sounds better?

Basic Strategies that Intelligent Directions can facilitate using Annuities and Insurance:

- Pure Long-Term Wealth Accumulation (Maximize Accumulation with Minimal Risk)

- Mitigate Personal, Family and Business Risks (Safe Wealth Accumulation, Health Issues, Premature Death, Taxes)

- Retirement Income (Longevity and Duration/Amount of Retirement Income, Taxes, and RMD Avoidance)

- Estate Planning (Maximize Wealth Transfer, Charitable Gifting, Taxes)

- Business Planning (Succession Planning, Business Financing, Retirement, Taxes)

Farmers have used insurance companies as their “bank” for decades. Highly-paid athletes (including Babe Ruth) and performers who had high earnings windows have known for over a century that Insurance Companies are a safer and more worry-free place to store and grow money. Investigate highly rated insurance companies, and you’ll find that their capital requirements are regulated to be much higher than banks and that they have historically far fewer failures than banks.

The financial press has been complicit in letting people forget the facts about Annuities and Insurance. Intelligent Directions wants to teach the past and bring it all back to the present.

The SECURE Act of 2019, promoting the use of annuities more in retirement planning, was just signed into law for a reason.

A limited few non-client specific Carrier Product Illustrations are posted as examples under the Contract News on this Home Page (below).

Better yet, give Intelligent Directions a call to answer any of your questions. We like questions and we’re easy to talk to.

Powerful Propositions…

Some Simple and Powerful Propositions That We Can Help You With:

- Build a safe low-maintenance income bridge into retirement, purposed for receiving your full Social Security

- For an Early and/or a More Fulfilling Retirement, Accumulate Additional Tax Deferred Savings Beyond What You Have in Your 401K’s and IRA’s. Start in 20/30/40’s and Let the Power of Compounding fuel growth even more!

- Plan For Tax-Free Wealth Transfer

- Setup a Multi-Purpose Tax-Deferred Fund that can be enhanced for wealth transfer and/or Long-Term Care

- Eliminate the Need To ever Apply For Another Bank Loan (Infinite Business and Personal Banking)

The IRS has allowed for these tax favorable concepts for decades, and unfortunately, many people have been brainwashed to ignore these products… brainwashed by facets of the financial press and industry advertising.

Phone: 760.792.8500Phone: 760.792.8500 Toll Free 24/7 Voice Mail: 800.354.8530Toll Free 24/7 Voice Mail: 800.354.8530 Contact UsContact Us

You might ask, do you “Put your Money where your mouth is?” I have personally bought ELEVEN (11!) Annuity Contracts for self/immediate family in last 3 years. WHY? To have Tax-Deferred Growth with Zero Market Downside Risk, by Adding A Low-Maintenance, Safer Asset Class to the Portfolio…some with Guaranteed Inflating Lifetime Income. Questions?

Available Contract News

Articles and Notes from Mike

From Financial Press

Testimonials

Contact Intelligent Directions

Upload Your Documents Here

Upload Your Documents Here

Contact Intelligent Directions

Michael H. Johnson

MBA, Deloitte AlumniContact Intelligent Directions Insurance Solutions. Mike always has time to explain the Mechanics and Benefits of Annuity and Life Contracts. Call: 760-792-8500 or 24/7 Voice Mail: 800-354-8530 Alternatively, please fill out the following form and Mike will respond as soon as possible.Intelligent Directions Insurance Solutions, LLC

24654 N. Lake Pleasant Pkwy

Suite 103-443

Peoria, AZ 85383

Serving ALL of Arizona: Phoenix, Tempe, Scottsdale, Glendale, Wickenburg, Surprise, Peoria. Mike is EASY to talk to and loves questions.

We encourage all potential clients regardless of age, to log in and create a secure individual Social Security access account: www.ssa.gov/myaccount/

We encourage all potential clients regardless of age, to log in and create a secure individual Social Security access account: www.ssa.gov/myaccount/Use the SSA toolset to gain an understanding of what Social Security claiming options you will have, and what to expect in terms of benefit amounts and protection. The SSA website is also useful in validating the reported income data (the paid-in amounts) that SSA receives each year from the IRS.